Although bonds offer minimal returns, their nature of minimized risk affords investors a safe haven for their capital while offering predictable appreciation. Bonds avoid the regular market volatility on other financial instruments such as stocks, commodities, and currencies. While the popular ideology among retail investors is inclined towards seeking a good yield, bonds are not primarily about that. Unknown to a significant number of people is that bonds offer capital protection, gains, and appreciation over time. Better yet, a bond Exchange Traded Fund (ETF) is more robust as it is balanced through the incorporation of different bond types.

On our series on Bonds in different markets, here are our Top Six US Bond ETFs that offer sound Investment Options;

- Vanguard Tax Exempt Bond ETF (VTEB)

The VTEB is tax-exempt making it more cost-friendly to investors. This fund is one of the low-cost investment options in the developed markets precisely the US. The fund’s annual expense ratio is 0.06%, which ideally is $6 for every $1,000 invested. Diversified across different US states and municipalities, the fund is concentrated on investment-grade bonds. This offers significant-high liquidity as it holds approximately 5,900 bonds. The Vanguard Tax-Exempt Bond ETF records a 1.83% annual yield.

2. Invesco National AMT-Free Municipal Bond ETF (ZPA)

The fund is another Federal tax-free investment option. It records a 2.3% yield and has an expense ratio of 0.28%. The ZPA offers a one percentage point higher yield than the 10-Year US Treasury Yield. It buys municipal investment-grade bonds and sells them once their rates rise.

The bond is often rebalanced and reconstituted every month to replace lagging securities. This enhances the onboarding of bonds that will allow for consistent returns to the fund. The funds attract higher yields because of its long-term holding of at least 15 years, importantly the holdings are weighted against market value, which provides a good value benchmark.

3. Primco Active Bond ETF (BOND)

This bond incorporates exposure to investment-grade corporate bonds with government-oriented ones. It has exposure to government emerging market bonds and high yield debt that helps boost yields to 2.53%. The bond’s expense ratio stands at 0.57%, a sound rate for an actively managed fund.

4. iShares Core 1-5 Year USD Bond ETF (ISTB))

The fund is concentrated on 95% investment-grade bonds with a mix of a little exposure to high-yield bonds. It helps to boost the bond’s yield while engaging a sizable level of credit risk.

5. Shenkman Capital Floating Rate High Income Fund (SFHIX)

The SFHIX is an actively managed fund, with an annual yield of 3.34%. Since it is a floating rate, the fund easily responds to changes in interest rates. The fund’s fees stand at 0.55% while holding a mix of credit-rated B and BB securities.

6. Vanguard Total International Bond ETF (BNDX).

Another investment option from the Vanguard Group is the Vanguard Total International Bond ETF. This is ETF Purchases non-us denominated investment-grade bonds, which mean an increased level of yields. 80% of these bonds are in the Asia Pacific and European Regions.

Guided by the belief of lower fees, the bonds are passively managed since they hardly need much attention hence less expensive to both the fund and client.

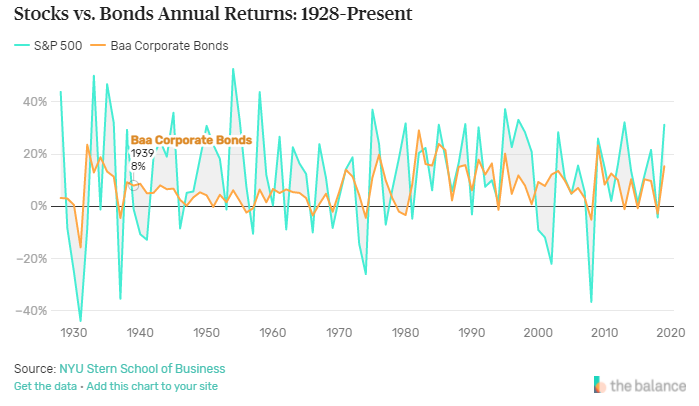

Summarily, the bond ETFs show consistent unanimity that they are relatively low cost and offer safe and less risky options for investors. Stocks performance are risky and sometimes inconsistent and irrational leaving an investor at huge losses. The below chart shows bond performance against stock performance in stocks between early 1928 and 2020.

Noteworthy, bonds offer subtle yet consistent growth that presents more value than yields alone. They allow for low exposure to risk, unlike stocks that can suddenly collapse and wipe out a huge portion of a portfolio. Sometimes stocks can have a portfolio totally wiped off save for the fact that they can soar in times of positive market sentiment. Inferentially, investing in bonds is more than just yields, there is a Total Return which is an amalgamation of yield and capital appreciation.

Fredrick Munyao

Related posts

Market Hacks

A look into Coinbase, What you Should Know

Cryptocurrency exchange platforms have offered crypto enthusiasts and investors reliable avenues that continue to increase in their popularity and reach….

Dogecoin, a hyped market sentiment?

The Crypto world keeps presenting new twists and turns into the investment space. Bitcoin experienced its soar, so did Ether….

What is a Trader Checklist? Here are Five Things.

Trading is one lucrative skillset that has the ability to generate short term returns that can be effectively deployed elsewhere…

How to Fight Inflation, The Use of Interest Rates.

Inflation is a word often pronounced in economic and financial circles. It has both positive and negative effects to a…

What is a Sovereign Wealth Fund? Here are the Top 5 Largest Sovereign Wealth Funds in the World.

A sovereign wealth fund is a pool of funds owned by an individual government that aims to invest partly or…