Bond markets allow individuals and entities to lend businesses, organizations, and governments at rates that offer attractive returns. However, these returns compared to other investment vehicles might be lower. Different investors have varying levels of risk appetite. Cognitively, bonds appeal more to risk-averse investors than risk-tolerant ones. Bond yields over the years have shown relatively conservative gains that allow for consistent and reliable returns. Bonds, especially to entities or organizations with good to excellent credit ratings offer worthy market returns that act as good storage of value that leverages on healthy interest rates to guarantee investors of agreed returns.

Types of Bonds

Bonds are varied and can be broken down into myriads of types. Fortunately, their duration offers a convenient and easy categorization of bonds. The duration categorizes bonds into two;

- Short Term

- Long Term

Short terms bonds last no longer than a year and are referred to as Treasuries. They can be 1, 3- or 6-month treasuries. This ideally means monthly, quarterly, and biannual treasuries for investors. Often, governments invest in treasuries and at times use them to stimulate economic growth.

On the other hand, long-term bonds can last up to 30 years offering consistent returns. Important to note is that bonds offered to governments and companies are referred to as government and corporate bonds respectively. Government bonds are less risky compared to companies. Fortunately, collateralization modalities shield investors from imminent risks such as asking for over-collateralization to cover the losses that could be incurred. Governments hardly default on domestic bonds hence a good investment idea.

Bond rates can be floating, fixed and zero-coupon. Floating bond rates offer fluctuating interest rates and could be adjusted to inflation over time. Fixed rates do not change and have a benchmark that allows for their determination, for instance, this rate is placed at a certain percentage above the LIBOR (London Interbank Offered Rate) or a Central Bank’s Rate. Zero-Coupon Bonds offer no-interest payments but give a return at the bond’s maturity.

Bonds seek high amounts of leverage to fetch significant returns for investors. Investors with less than average amounts might not realize relatively significant returns due to their inherent low-interest rates. Unlike bonds, stocks offer better rates and allow for more flexible reinvestment. Clauses in bond agreements known as bond indentures allow investors to have options to convert their bonds to stock ownership referred to as convertible bonds) or ask for returns when interest rates favor them and this right is referred to as a put option). Borrowers can also repay their debt at interest rates that favor them especially in floating-rate bonds, this option is known as a call option.

Yield Curve

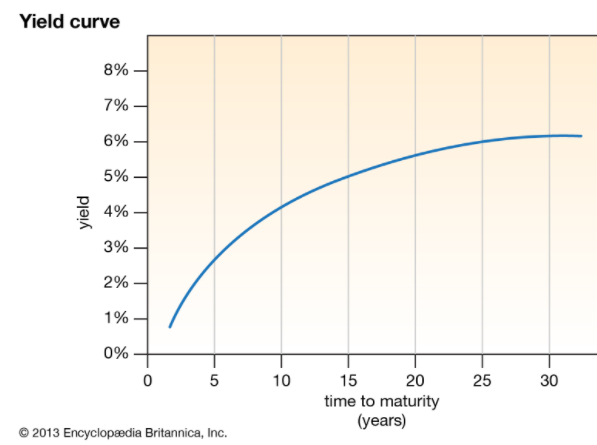

The yield curve shows the amount of returns that bonds give over time. It is a comparison of long-term and short-term bond market returns. When long-term bond market returns are more than short-term ones, the yield curve is said to be normal and indicates an economic expansion.

When long-term bond returns are equal or almost equal to the short-term returns, the yield curve is said to be flattening and is referred to as a flat yield curve. Flat yield curves point to an economic transition, either a recession or expansion. Short-term bond market returns that exceed long-term bond market returns translate to an inverted yield curve, Inverted yield curves are a proponent of an economic recession hence defines a risk-off bond market.

Want to see different bond markets’ performance? Watch out for our next articles and see a market breakdown on bonds in developed markets, emerging economies, and developing markets.

Fredrick Munyao

Related posts

Market Hacks

A look into Coinbase, What you Should Know

Cryptocurrency exchange platforms have offered crypto enthusiasts and investors reliable avenues that continue to increase in their popularity and reach….

Dogecoin, a hyped market sentiment?

The Crypto world keeps presenting new twists and turns into the investment space. Bitcoin experienced its soar, so did Ether….

What is a Trader Checklist? Here are Five Things.

Trading is one lucrative skillset that has the ability to generate short term returns that can be effectively deployed elsewhere…

How to Fight Inflation, The Use of Interest Rates.

Inflation is a word often pronounced in economic and financial circles. It has both positive and negative effects to a…

What is a Sovereign Wealth Fund? Here are the Top 5 Largest Sovereign Wealth Funds in the World.

A sovereign wealth fund is a pool of funds owned by an individual government that aims to invest partly or…